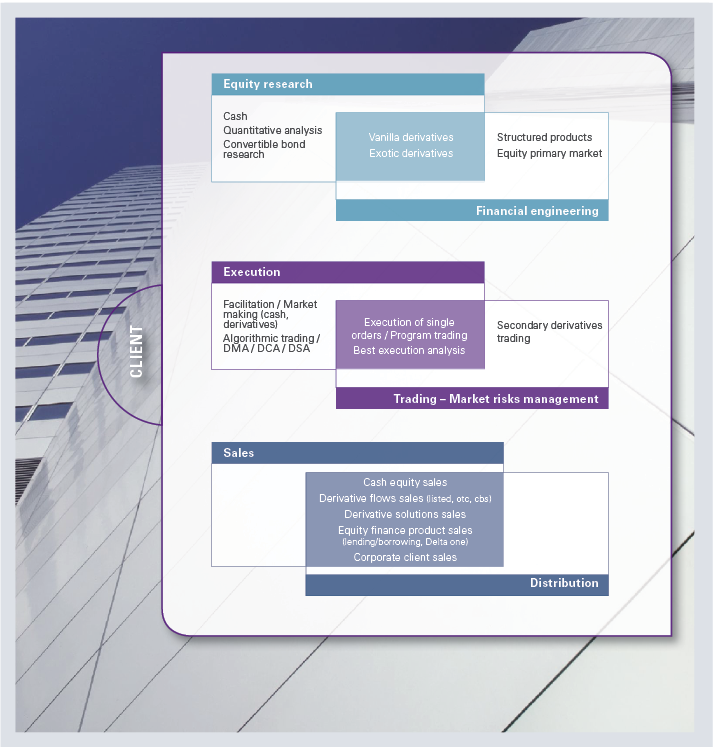

• Equities: Coverage of 350 European stocks in 23 industrial sectors; cross-sector

research (SRI and strategy).

• Quantitative research: Development of sophisticated analysis tools and proprietary

quantitative investment strategies.

• Convertible bond research: Coverage of 210 European convertible bonds, fundamental

approach (equities and credit) and themes specific to convertible bonds (OST, ratchet,

dividends, etc.).

• Derivative research: Applying all the resources of fundamental, technical and

derivative research, the derivatives research team provide the sales teams with

market analyses and tactical and strategic investment recommendations.

Natixis clients enjoy access to the expertise of the Natixis economic research department headed by Patrick Artus,

which notably offers:

• Coverage of some 60 countries, including the main emerging economies

• Economic and financial forecasts as well as the macroeconomic and geopolitical

reports published by our experts.

Natixis clients can subscribe to a wide range of research publications:

• Market analyses: market information, daily stock recommendations, fundamental

studies focusing on specific stocks, sectors, strategy and SRI, stock guide, volatility

analyses, specific analyses of convertible bonds.

• Investment recommendations: derivatives tactics, strategy suggestions, “NXS Indices”

range (Natixis’s proprietary investment strategies).

• Market and economic analysis tools: academic research, market indicators, derivatives

modelling, etc.

Natixis’s risk management expertise spans the entire range of equity derivatives,

relying on more than 93 trading professionals operating across the globe.

Trading platforms in New York, London, Paris and Hong Kong provide clients with

direct access to the full spectrum of underlyings, including trackers.

Its long-recognised experience in correlation and volatility trading makes Natixis

the perfect partner for products based on “hidden assets”.

A major player in securities lending, Natixis also offers its clients access to

the full range of equity financing solutions to optimise returns.

Global access to equity markets

Algorithmic execution

• Proprietary algorithms: vwap, twap, participate, close, iceberg, hunt, etc.

• Direct Market Access (DMA)

• Direct Capital Access (DCA)

• Direct Strategy Access (DSA)

Tailored single-order execution

• A Paris-based team of ten pan-European traders-dealers Smart Order Router

• Access to a large number of alternative platforms Program trading – Pair trading

– Market making

• Dedicated teams for each activity

• A comprehensive range of customised products

Internal matching

Order routing for networks and management companies Best execution analysis

Best execution analysis

Confirmed expertise in derivatives trading

Transversal Derivatives trading Desk

• Secondary market on structured products

• OTC products

• Convertible bonds market making

• Equity linked bonds

• Structured funds